Careshield Life Supplement

1600 per month premium of 57797 per year 100 payable by Medisave from 2020-2025 rates will be readjusted by based on recommended premium adjustments thereafter. Spouse parents children siblings or grandchildren MediSave up to a limit of 600 per calendar year per person insured.

Careshield Life Supplement Should You Upgrade

Only 3 insurers namely Aviva NTUC Income and Great Eastern are authorised to provide CareShield Life Supplement plans which can conveniently be paid using your Medisave account for up to 600 per calendar year per LAAs the supplement plan for Great Eastern is only launching on 19 Oct we will only be comparing the Aviva MyLongTermCare plan MyLongTermCare Plus plan and NTUC Care.

Careshield life supplement. What does a CareShield Life Supplement cover include. Vitamin e vitamin e is an antioxidant a substance that protects agai. This would be more sensitive.

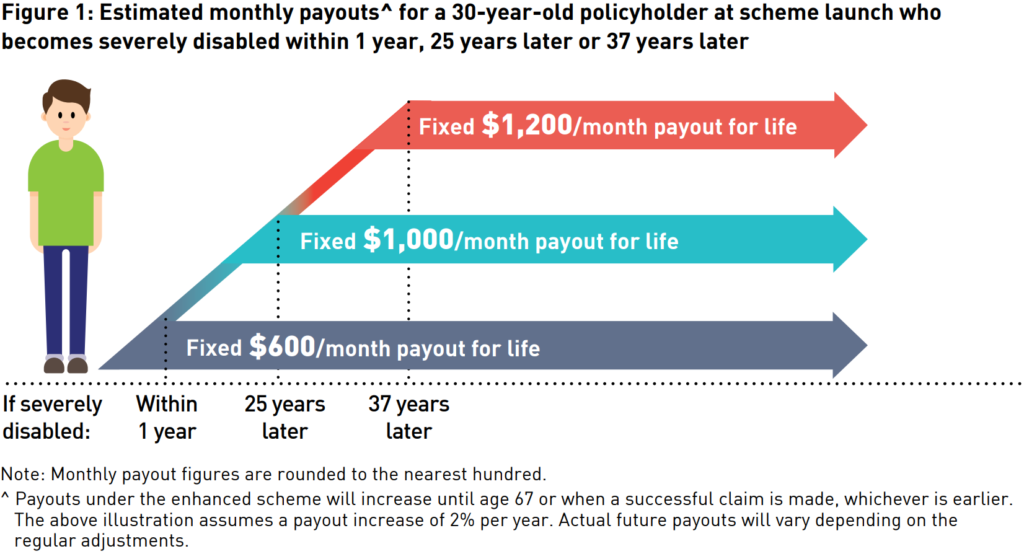

This is defined as the inability to perform at least 3 out of 6 Activities of Daily Living ADLs with the six ADLs being washing dressing walking feeding transferring and toileting. CareShield Lifes payout criterion is set at the inability to perform 3 out of 6 ADLs. Higher monthly payouts for a lifetime.

So far there are 3 insurance companies offering Careshield Life Supplement Aviva Income and great Eastern but I was wondering how worth it is it for us to purchase the supplement. CareShield Life supplements provide more coverage for both moderate and severe disability coupled with higher long-term care payouts to minimise any out-of-pocket expenses. You also have the flexibility to increase the monthly payout up to 5000 per month and the payout can be pegged to inflate up to 3 per annum.

Lifetime premium payment option unlike Care Secure up to age 84 which is our life expectancy. Enter CareShield Life Supplement Plans. Higher payouts longer payout duration can consider purchasing Supplements from any of the ElderShield insurers.

NTUC Care Secure provides you with monthly disability benefits of up to 5000 depending on the. And as at 2 Oct 2020 theres at least one company that allows you to upgrade with their new CareShield Life supplement even though youre on ElderShield. Payout Starts at 600 And Increases by 2 Per Year.

Similar with the Aviva ElderShield supplement MyCare I think Aviva CareShield Life supplement still the best in the market with so many additional benefits. Supplemental life insurance is a policy that boost the value you get from a group life insurance policy you have through your employer. What is CareShield Life.

Under Aviva you can choose between MyLongTermCare and MyLongTermCare Plus. Beyond CareShield Life coverage you can only upgrade using supplement plans. CareShield Life and its supplement plans is one of the few that offers lifetime long-term care insurance.

ElderShield and CareShield Life insureds who wish to have higher coverage eg. More information about CareShield Life Supplements will be released by the insurers after the launch of CareShield Life on 1 October 2020. 5 ElderShield Supplement vs CareShield Life Supplement.

Premiums for your Supplements can be paid by cash or using your own or your family members ie. Buy now Please note that only Singapore Citizens and Permanent Residents born between 1980 to 1990 aged 30 to 40 in 2020 with a CareShield Life policy are currently eligible to apply. There are only 3 authorized insurer for CareShield Life.

Receive a Lump Sum Benefit Rehabilitation Benefit3 Dependant Care Benefit Caregiver Relief Benefit and Death Benefit. CareShield Life supplements are policies that supplement the coverage of the basic CareShield Life policy. CareShield Life supplement payouts upon the inability to perform 2 out of 6 ADLs.

CareShield Life supplements are policies that supplement the coverage of the basic CareShield Life policy. There are no restrictions on the number of supplement policies one can be covered. Currently there are three insurers who offer CareShield Life Supplement plans namely Aviva MyLongTermCare MyLongTermCare Plus NTUC Income Care Secure and Great Eastern GREAT CareShield Additional premiums for a CareShield Life Supplement plan can be paid either in cash or using funds from your MediSave account or that of your family members spouse parents.

I like best the. Criteria to claim monthly payout inability to perform ADLs. On top of your CareShield Life payouts choose to receive additional S200 to S5000 per month when youre unable to perform at least 2 out of 6 ADL2.

A form of disability insurance CareShield Life provides basic financial support for all Singaporeans should they become severely disabled. Without consideration of the premiums Aviva still looks the best. Insured persons who are severely disabled will be able to receive payout for as long as he or she lives.

Payouts start at 600 per month in 2020 and will increase over time. Supplement your CareShield Life plan with enhanced long-term coverage against moderate and severe disabilities. Initial benefit upon successful claim.

You may also wish to speak to a financial advisor from one of the private insurers who can share more about their Supplement plans and their implications. Careshield Life supplement payout. Additionally you can utilize your MediSave account with an Additional Withdrawal Limit AWL of 600 to get this supplement plan.

With the CareShield Life that just came out it is also time for insurance company to cash in on this. Supplement premiums can be paid using MediSave up to a limit of 600 per calendar year per person insured. The plan offers a monthly payout in the event of severe disability providing basic financial support for long-term care costs.

CareShield Life is a national insurance scheme for Singaporeans and PRs born in 1980 and later. Comparing Different CareShield Life Supplements NTUC Care Secure. Best Upgrade Option While we receive compensation when you click lin.

By coupling Careshield Life with the Careshield Life supplement plan I will get at least 2200month payout if I am unable to perform 3 ADLs. Best CareShield Life supplement plans Policy term. Careshield Life Supplement Careshield Life Supplement.

If not you can wait till end 2021 and enrol into CareShield Life andor its supplements. Lifetime cash payout as long as remained severely disabled. CareShield Life Supplements comparison.

But note that you will need to be an existing policyholder under CareShield Life to purchase a supplement policy. CareShield Supplement plans have lower criteria at 2 out of 6 ADLs.

Launch Of Careshield Life In 2020 How Does It Affect You Providend

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg

Careshield Life Supplement Synergy Financial Advisers Facebook

Careshield Life Caring For You For Life

Review Best Careshield Life Supplement Option In Depth Analysis Tree Of Wealth

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg

Cheat Sheet Careshield Life Supplement Plans You Must Know If You Re Above 30 The Big 3

4 Reasons Why Jon Didn T Consider Enhancing His Careshield Life

Cpfb Careshield Life For 40 And Above

Best Careshield Life Supplements In Singapore 2021 Homage

Careshield Life Supplements Comparison Aviva Still The Best Cpf3life Com

If Only Singaporeans Stopped To Think Careshield Life Singapore S National Disability Insurance Will Be Launched On 1 October 2020

Careshield Life Ultimate Guide For Singaporeans Prs

Best Careshield Life Supplements In Singapore 2021 Homage

Complete Guide To Buying A Careshield Life Supplement Plan

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg